This is a question I have heard a few times from friends and Associates.

Does it make sense to just buy a property and rent it out on AirBnB Full time?

Inevitably, I get this question once people realize that is essential what I did with my vacation rental in Waikiki, but the details are what always trips them up.

So if you want a quick answer to the question: It depends! But it could very well make financial sense.

Here is what you need to know

1) Commercial vs Regular Home Loans

Buying a property is a big deal. And buying a property with the intent to rent it out and not as a primary residence is a bigger deal than most people realize. Normally, when qualifying and shopping around for a mortgage, you are looking for a place to live.

Once you are looking for place with no intention to live there, the loans get more expensive. Sometimes, a lot more expensive and more difficult to qualify for. Instead of being able to offer 10% down and get a decent rate, you will most often need to put down 30-40% of the purchase price. Ouch! Also, the interest rate will be a bit higher.

If you go in with this approach upfront, it is going to cost you more money for sure. But if you can qualify for a commercial loan, even better! As commercial loans often look at the property rental income as a big source of income when approving the property (more so than in a personal loan).

A lot of people will apply for a personal loan even when their true intentions are just to rent it out 100% of the time. I definitely don’t recommend this, as the mortgage company can recall the loan to be due immediately if they find out. It is best to do it all on the up and up!

So, in some situations it will make sense. We will review those a bit later in this article.

2) The Lookback Period on Current Rental Income

This is another tricky one and is almost universal when applying for mortgages. Banks do not count any rental income on a property unless you have a two year history of rental income on your tax returns.

This is a big one, because if you are applying for a mortgage, even if your rental property (AirBnB and otherwise) is making good bank, it will only be a liability on your balance sheet until you haver two years of positive tax returns.

So, consider that from the time you purchase one property, it could be 2 years + the time it takes to file your taxes (at least a few months). If you buy the property mid year, it may not even show enough revenue for your next loan. So again, it could take 3 years from the time you purchase one property until the time you purchase. Just keep this in mind.

3) I qualified for financing already, but I’m not sure if it will work in my market?

OK assuming you got past the first two bottlenecks and got your financing in order and a bank ready to underwrite a property for you, the next thing to do is complete an AirBnB market analysis.

This will show you the basics of your local market, what the average price per night is in your area, and approximate occupancy rate.

These are the value you need to determine from your market analysis to plug into our formula below. Besides obvious things like: Purchase Price, Down payment, Mortgage APR, taxes, etc, you will need the following AirBnB specific info:

Average Occupancy Rate

Average Price Per Night

Average Stay Length

Will it work for me?

To finally answer the question, will it work for you? Well you need to do a few calculations to get there!

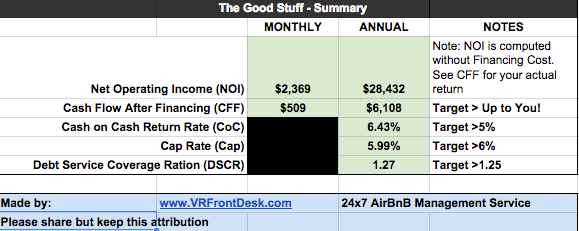

Once you get the key value, CFF (Cash Flow From Financing) and CoC (Cash on Cash Return), then you can decide if this is a good investment for you or not!

Also if you are applying for a commercial loan, come to the loan officer with these values and you will look like somebody who is prepared and has done their homework!

Want to Download this Spreadsheet? Signup for the mailing list today and a copy is yours!

Steps 1 and 2

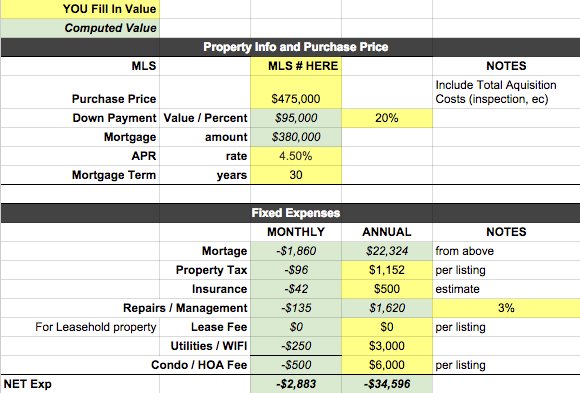

1) Step one determine your financing, percent down payment, etc. You can do this with our spreadsheet, or any mortgage calc online will do the trick!

2) List out all your fixed costs, things like insurance, etc. Most of these can be found in the MLS listing, although some you may need to estimate. The Management / Repairs line will vary greatly depending on how you manage the property. I used 3% in this example because I manage it myself and 3% is the baseline for repairs. If you manage it with a company it could be anywhere from 3-30%! Or if you use VR Front Desk to manage your AirBnB Rental..it is as low as $69 a month 🙂

Steps 3 and 5

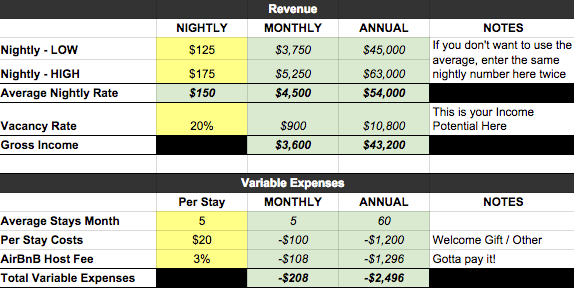

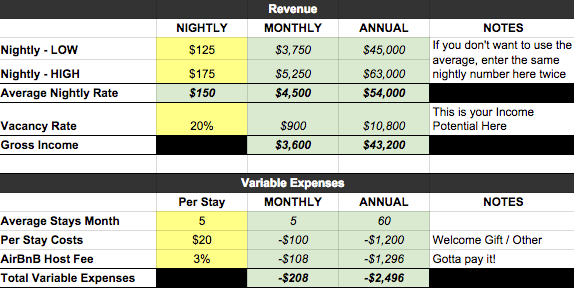

3) Determine Revenue and vacancy rate per your AirBnB Market analysis above.

4) Determine per stay costs and AirBnB fees. AirBnB host fee is always the same, but your per stay cost may vary depending on if you subsidize part or all of the cleaning fee and what kind of welcome gift you provide.

Step 5

5) Calculate! Our nifty AirBnB Expense Calculator will do it all for you (sign up to the mailing list to get a FREE copy), just plop in the values.

[formlightbox_call title=”Free Spreadsheet!” class=”002″] [/formlightbox_call]

[/formlightbox_call]

[formlightbox_obj id=”002″ style=”” onload=”false”]

[/formlightbox_obj]

Hi I signed up for the email newsletter but didn’t get the copy of hte expense calculator. Could I get that copy please?

Thanks, Christina

Hi Christina, ok I’ll send you a copy directly! Also I’ll try to figure out why you didn’t get the link, I’ll have to check my mailing list settings to make sure the Airbnb Expense Calc is included.

I signed up for the email newsletter but didn’t get the copy of hte expense calculator.

Thank you

Hi William,

Sorry about that the link is supposed to be sent out as soon as you signup. If you still have not received it, please use the contact form on our website and an agent will send it to you right away.

Hello Aaron

I’m in the same boat as Williams. Looking your book so far!

Thank you

Hey Harrison, No problem, just sent you the spreadsheet! Let me know if you have any questions.

Aaron

Hi Aaron, same issue. Signed up but no spread sheet. Can you send? Thanks.

Check the email you should have received from the mailing list, it is in the Welcome email as Link #2. FYI the first link in there is for a free 5 point detailed listing review spreadsheet – good stuff!

Hello,

I signed up for the newsletter, but never received the spreadsheet. Can you please send me one?

Sent – Please check your email!

I’m on this page on your website: https://yourfrontdesk.co/does-it-make-sense-to-buy-a-property-for-the-exclusive-use-of-renting-out-through-airbnb/

It says to sign up for the newsletter to receive the excel template. I filled in my name and email but there is no “submit” button. How do I sign up??

Thanks for signing up! The link to the spreadhseet is in your welcome email! Please make sure to check spam an mark it as not spam so you get our emails in the future. IF you need me to resend it, just let me know via our contact form.